Life insurance is a cornerstone of financial planning, offering peace of mind and financial protection to individuals and their loved ones. Among the various types of life insurance, term life insurance is one of the most popular and straightforward options available. It is designed to provide coverage for a specific period or “term” and is often the go-to choice for people seeking affordable and straightforward protection. But what exactly is term life insurance, and how does it work?

In this comprehensive article, we will explore everything you need to know about term life insurance, including its features, benefits, limitations, and how it fits into your financial planning. We will also address common questions and clarify important concepts to help you make informed decisions.

Key Takeaways

- Term life insurance provides coverage for a fixed period with a death benefit if the insured dies during the term.

- It is typically more affordable than permanent life insurance because it lacks cash value accumulation.

- Choosing the right term length and death benefit amount is essential to meet your financial obligations.

- Term policies can sometimes be renewed or converted, offering some flexibility.

- It is best suited for individuals seeking affordable, temporary protection.

- Understanding the terms, premiums, and exclusions helps avoid surprises.

- Comparing multiple quotes and insurers can help secure the best policy for your needs.

What is Term Life Insurance?

Term life insurance is a type of life insurance policy that provides coverage for a predetermined period, or “term,” such as 10, 15, 20, or 30 years. During this term, if the insured person passes away, the insurance company pays out a death benefit to the designated beneficiaries. However, if the insured survives beyond the term, the policy expires without value unless renewed or converted to a permanent policy.

Key Characteristics of Term Life Insurance:

- Temporary Coverage: Coverage lasts for a fixed term.

- Death Benefit: Pays a lump sum to beneficiaries if the insured dies during the term.

- No Cash Value: Unlike whole or universal life insurance, term insurance has no savings or investment component.

- Lower Premiums: Typically more affordable compared to permanent life insurance.

How Does Term Life Insurance Work?

The mechanics of term life insurance are straightforward, which is why it’s a popular choice for many individuals seeking financial protection without complexity. Here’s a step-by-step breakdown of how term life insurance typically works:

1. Choosing a Term Length

The first step is to decide how long you want your life insurance coverage to last. Term lengths usually come in increments of 10, 15, 20, or 30 years. This choice should be guided by your financial goals and obligations. For instance, if you want coverage to last until your mortgage is paid off or until your children finish college, you might select a term that matches those timeframes.

Choosing the right term length is crucial — if you select too short a term, you risk being uninsured after it expires. Conversely, a longer term usually means higher premiums but extended protection.

2. Determining the Death Benefit

Next, you decide the death benefit — the lump sum amount that your beneficiaries will receive if you pass away within the policy term. This amount should ideally cover your family’s immediate financial needs, debts, future expenses such as education, and income replacement. The death benefit can vary widely, from $50,000 to several million dollars, depending on your financial responsibilities and what you want to leave behind.

An accurate estimate helps ensure that your loved ones are financially secure in your absence.

3. Paying Premiums

To keep the policy active, you must pay premiums regularly. These payments are typically monthly, quarterly, or annual, depending on your preference and the insurer’s options.

Premium amounts are influenced by several factors:

- Age: Younger individuals generally pay lower premiums.

- Health: Healthier applicants get better rates.

- Lifestyle: Smokers or those with risky hobbies pay more.

- Term Length: Longer terms usually cost more.

- Death Benefit: Higher coverage amounts come with higher premiums.

Because term life insurance policies do not accumulate cash value, the premiums tend to be significantly lower than those for permanent life insurance policies, making it a budget-friendly option.

4. Coverage Period

Once your policy is active, you have coverage for the entire term as long as you continue paying premiums on time. If you pass away during the term, the insurer pays the death benefit to your named beneficiaries, providing them with financial support.

If you outlive the term, however, the policy expires. You don’t get any money back since term life insurance is “pure insurance” without any investment component.

5. Renewal or Conversion Options

Many term life policies include options to renew coverage once the term ends, often without requiring a new medical exam. However, premiums usually increase upon renewal, reflecting your older age and potential health changes.

Some policies also allow conversion to a permanent life insurance plan, such as whole or universal life insurance, which builds cash value and provides lifelong coverage. This conversion is often available without additional health underwriting, but the premiums for permanent policies will generally be higher.

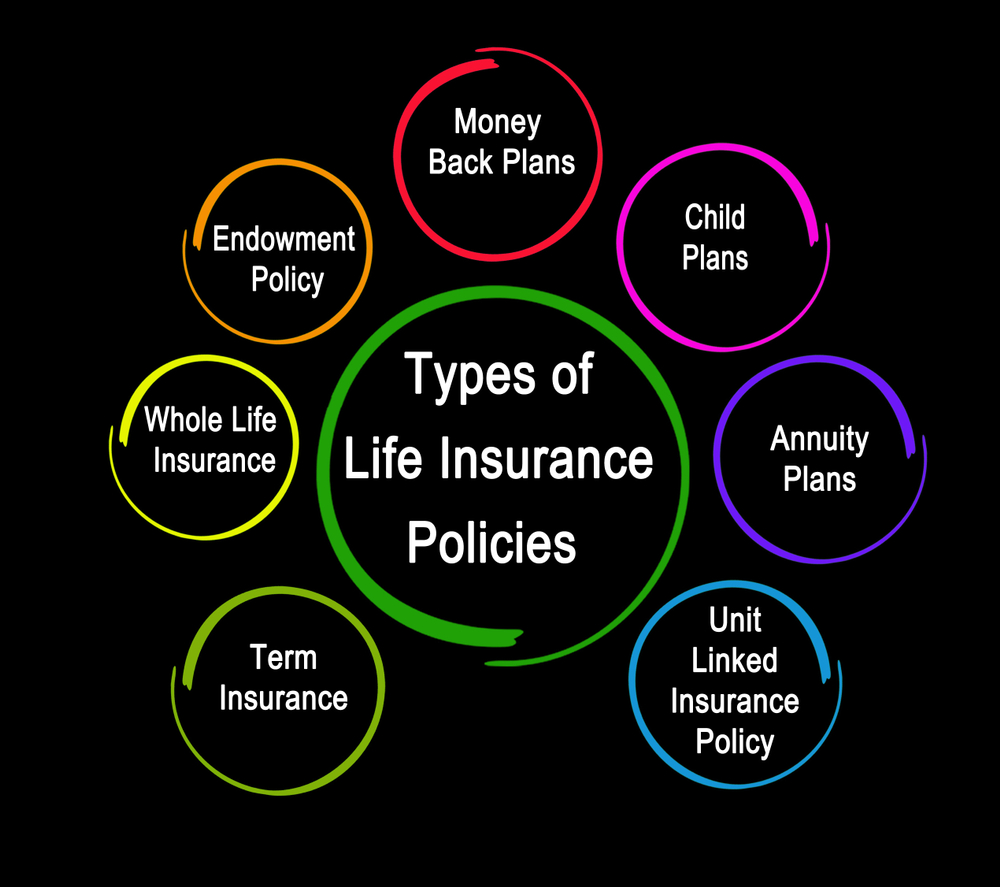

Types of Term Life Insurance

Term life insurance is not a one-size-fits-all product. Various types of term policies exist to address different financial situations and preferences. Understanding these can help you choose the best fit for your needs.

1. Level Term Life Insurance

Level term life insurance is the most common and straightforward type of term policy. In this policy, both the death benefit and the premium remain constant throughout the entire term period.

- Death Benefit: The payout amount your beneficiaries receive remains the same from the first day of the policy until it expires.

- Premium: Your premium payments also stay stable, which makes budgeting easier since you know exactly what you owe month after month.

This type of policy is ideal if you want predictable costs and steady coverage over your chosen term. It’s especially popular for covering fixed financial obligations like raising children, paying off a mortgage, or replacing lost income during your working years.

2. Decreasing Term Life Insurance

Decreasing term life insurance features a death benefit that declines gradually over the policy term, while premiums typically remain level.

- Death Benefit: The payout reduces over time, usually in line with a specific debt or liability, such as a mortgage or loan balance.

- Premium: Premiums generally stay the same throughout the term, even as the death benefit decreases.

This type is often used to cover financial obligations that decrease over time — for example, the balance on a mortgage loan. If you pass away early in the term, your beneficiaries get the full death benefit; but as the loan is paid down, the benefit decreases accordingly.

While cheaper than level term initially, decreasing term insurance might not provide enough coverage if your financial needs do not align with the decreasing payout.

3. Renewable Term Life Insurance

Renewable term life insurance policies allow you to extend coverage beyond the original term without needing to undergo a new medical exam.

- Renewal: At the end of the term, you can renew the policy for another term, maintaining coverage without fresh underwriting.

- Premiums: Premiums will likely increase upon renewal because your age and health risk have changed. The premium hike can be significant, especially if you renew multiple times.

Renewable term policies provide flexibility for those who want to maintain coverage but might not want to commit long-term upfront. However, due to rising premiums with each renewal, it’s often more cost-effective to shop for a new policy or consider permanent life insurance after the initial term ends.

4. Convertible Term Life Insurance

Convertible term life insurance gives you the option to convert your term policy into a permanent life insurance policy without undergoing a medical exam.

- Conversion: Usually possible anytime during the term or before a certain age, the conversion option allows switching to whole life, universal life, or another permanent policy.

- Benefits: This option is valuable if your health deteriorates and you might otherwise struggle to qualify for new coverage. It offers peace of mind and flexibility.

Benefits of Term Life Insurance

Term life insurance offers several distinct advantages, making it a highly attractive choice for many individuals and families. Here are some of the key benefits:

1. Affordability

One of the most significant advantages of term life insurance is its affordability. Because term policies provide coverage only for a specific period without accumulating any cash value, the premiums are typically much lower than those for permanent life insurance.

- Why it matters: Younger and healthier individuals benefit from lower premiums, making it easier to secure substantial coverage without straining their budget.

- Example: A 30-year-old non-smoker might pay a fraction of what they would for a whole life policy, allowing them to maximize coverage for critical years like raising children or paying off a mortgage.

This cost-effectiveness makes term life insurance a practical choice for those who want to protect their family’s financial future without sacrificing current financial flexibility.

2. Simplicity

Term life insurance is straightforward and easy to understand, which is a considerable benefit compared to more complex insurance products.

- What this means for you: There are no confusing investment components, cash values, or fees to worry about—just a simple agreement that if you pass away during the term, your beneficiaries receive a predetermined payout.

- Ease of management: Since terms and premiums are fixed, managing your policy and budgeting for premiums is hassle-free.

This simplicity allows policyholders to focus on their financial goals without getting bogged down in complicated policy details or investment performance.

3. Financial Protection

Term life insurance provides essential financial protection during your family’s most vulnerable years.

- Coverage for dependents: The death benefit can help cover mortgage payments, outstanding debts, childcare and education costs, daily living expenses, and even funeral costs.

- Income replacement: If you are the primary earner, your family can maintain their standard of living even after your death.

- Peace of mind: Knowing that your loved ones will have financial support in the event of your untimely passing alleviates worry and stress.

The financial cushion term life insurance offers can be life-changing for families relying on your income.

4. Flexibility

Many term life insurance policies offer features that adapt to your changing needs over time.

Customizable terms and coverage: You can select a term length and death benefit amount that match your current obligations, tailoring the policy to your financial situation.

Renewal options: You can renew coverage at the end of your term without a medical exam, although premiums may increase.

Conversion options: Some policies allow you to convert your term insurance into permanent life insurance if your circumstances change, such as needing lifelong coverage or building cash value.

Drawbacks of Term Life Insurance

1. Temporary Coverage

If you outlive the term, the policy expires, and you receive no payout.

2. Increasing Premiums

If you renew the policy after the term ends, premiums can rise significantly due to age or health changes.

3. No Cash Value

Term insurance does not build savings or investment components, unlike permanent policies.

Who Should Consider Term Life Insurance?

Term life insurance is best suited for people who:

- Need coverage for a specific period (e.g., until children are grown or a mortgage is paid).

- Seek affordable protection.

- Do not want or need investment or savings components.

- Want simple, straightforward coverage.

How to Choose the Right Term Life Insurance

1. Assess Your Needs

Calculate your financial obligations, including debts, mortgage, education costs, and income replacement needs.

2. Choose a Term Length

Select a term that matches your financial responsibilities or anticipated needs.

3. Compare Quotes

Get quotes from multiple insurers to find competitive premiums.

4. Understand Policy Terms

Look for features like renewal options, conversion rights, and exclusions.

5. Review Your Health

Health factors significantly affect premiums. Some policies require a medical exam.

Common Misconceptions About Term Life Insurance

- “Term insurance is wasted money if I don’t die during the term.”

While term policies don’t pay out if you outlive the term, they provide peace of mind and financial protection during critical years. - “Permanent life insurance is always better.”

Permanent insurance has benefits but is more expensive and complex. Term insurance is ideal for temporary, affordable protection. - “I don’t need life insurance if I’m young and healthy.”

Buying term insurance young locks in low premiums and protects your family in case of unexpected events.

Also Read:-What Is LCV Vehicle Insurance and Why Do You Need It?

Conclusion

Term life insurance is a practical, affordable, and straightforward way to protect your loved ones financially during critical periods. It offers temporary coverage that can cover debts, replace income, and provide peace of mind without the complexity and cost of permanent policies. By understanding how term life insurance works and evaluating your personal financial needs, you can select a policy that offers the right balance of coverage, cost, and flexibility.

FAQs

1. How much term life insurance coverage do I need?

You should aim to cover your outstanding debts, future living expenses for your dependents, education costs, and any other significant financial obligations.

2. Can I renew my term life insurance policy after it expires?

Many term policies offer renewal options, but premiums will typically increase with age and health changes.

3. What happens if I miss a premium payment?

Most insurers provide a grace period (usually 30 days) to make a payment before the policy lapses.

4. Can I convert a term life policy to permanent life insurance?

Some term policies include conversion options, allowing you to switch to permanent insurance without a medical exam.

5. Is a medical exam required for term life insurance?

Many insurers require a medical exam, but some offer no-exam policies at higher premiums.

6. Are term life insurance benefits taxable?

Death benefits from term life insurance are generally income tax-free to beneficiaries.

7. Can I buy multiple term life insurance policies?

Yes, you can hold multiple policies to tailor your coverage to different needs or amounts.